Exploring Market Leaderboard

The Solscan Market Leaderboard is a dashboard for monitoring on-chain DeFi market activity across Solana. It combines ecosystem-level overview metrics with a market-by-market ranking, allowing users to track liquidity concentration, trading intensity, and active participation across AMMs and DeFi programs.

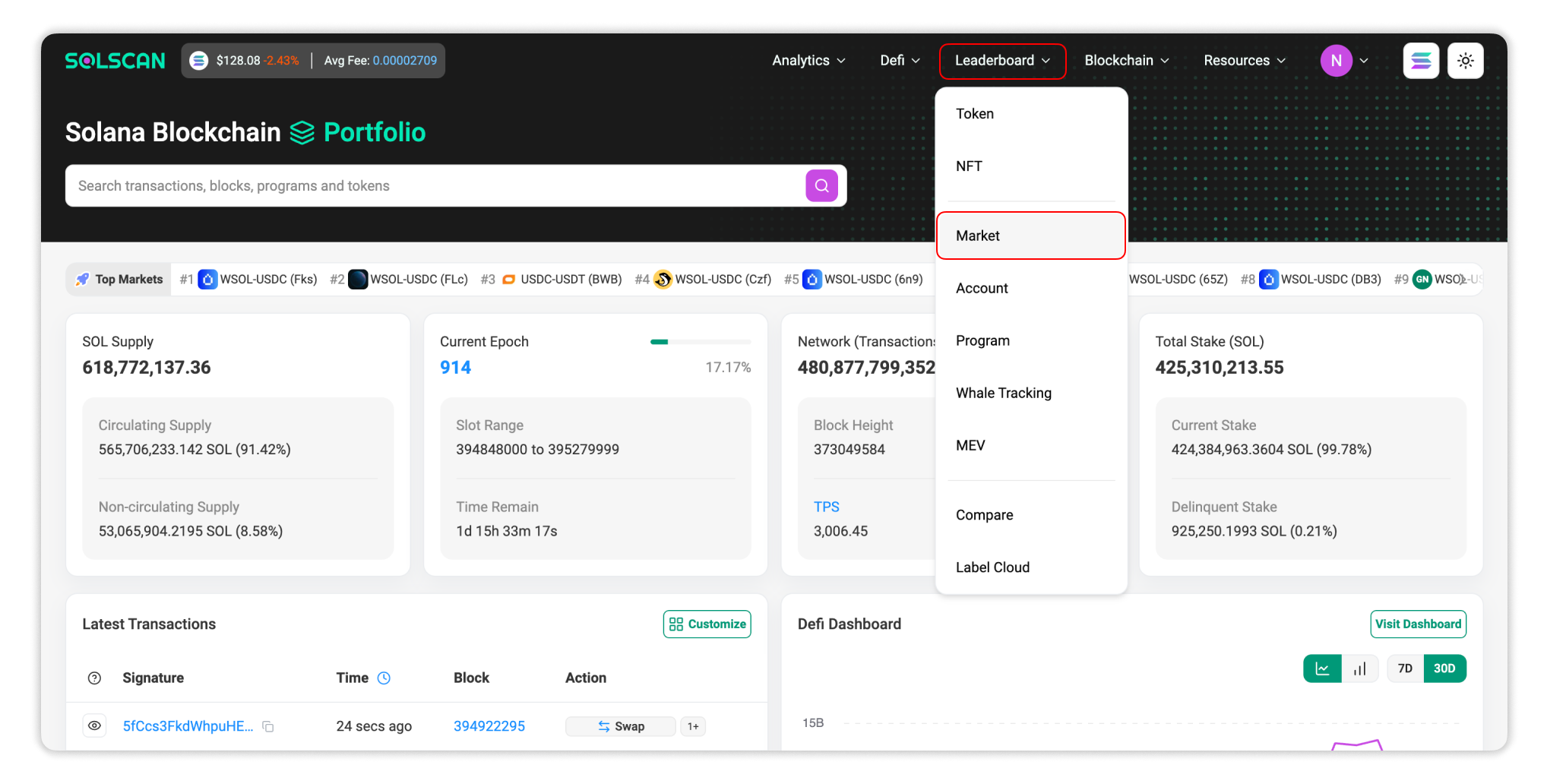

Locate the Leaderboard

You can access the Market Leaderboard through Solscan:

- Open Solscan website.

- Select Leaderboards → Market from the navigation menu.

Alternatively, you can bookmark the leaderboard using the direct link to Solscan Market Leaderboard.

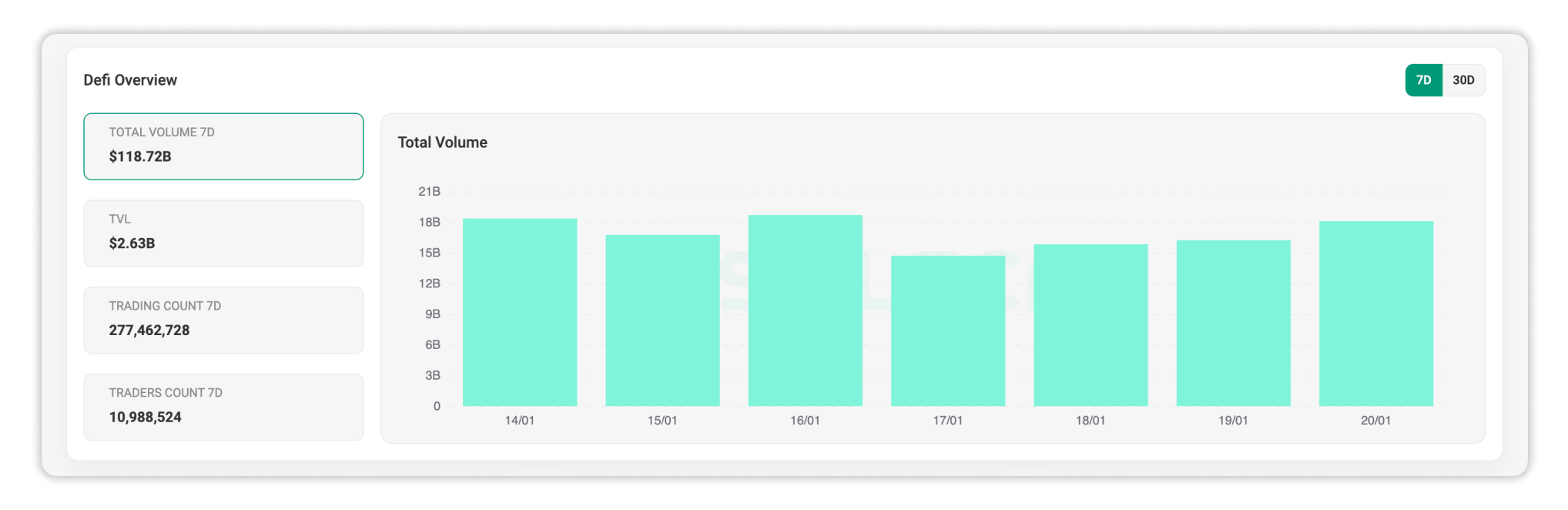

Section A: DeFi Overview (7D/30D)

At the top of the page, the DeFi Overview chart summarizes Solana-wide DeFi market activity over the last 7 days or 30 days. This section provides a high-level view of ecosystem conditions before drilling into individual markets.

- Total Volume: The total traded volume across tracked DeFi markets during the selected period.

- TVL: The total value locked across tracked markets, reflecting liquidity depth and capital deployment.

- Trading Count (7D/30D): The total number of executed trades over the last 7 days.

- Traders Count (7D/30D): The total number of unique traders interacting with markets during the last 7 days.

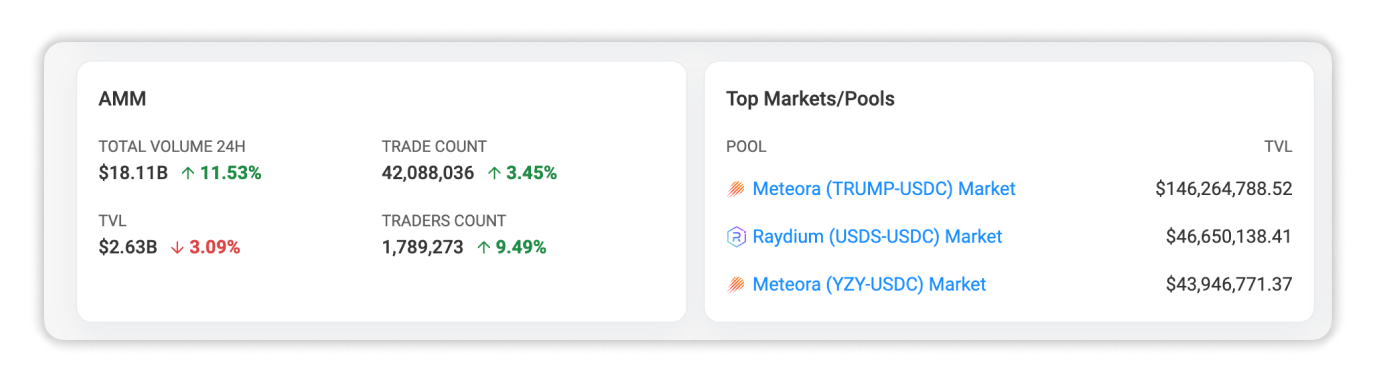

Section B: AMM Overview (24H)

The AMM Overview provides the same type of signals as the DeFi Overview, but focused on a 24-hour window. This makes it useful for tracking short-term market conditions.

- Total Volume (24H): The total swap volume executed through AMM markets during the last 24 hours.

- TVL: The total liquidity available across tracked AMM markets.

- Trading Count (24H): The number of trades executed through AMMs in the last 24 hours.

- Traders Count (24H): The number of unique traders participating in AMM activity within the last 24 hours.

Section C: Top Markets/Pools (by TVL)

The Top Markets section lists top 3 markets with the highest TVL, showing where liquidity is most concentrated.

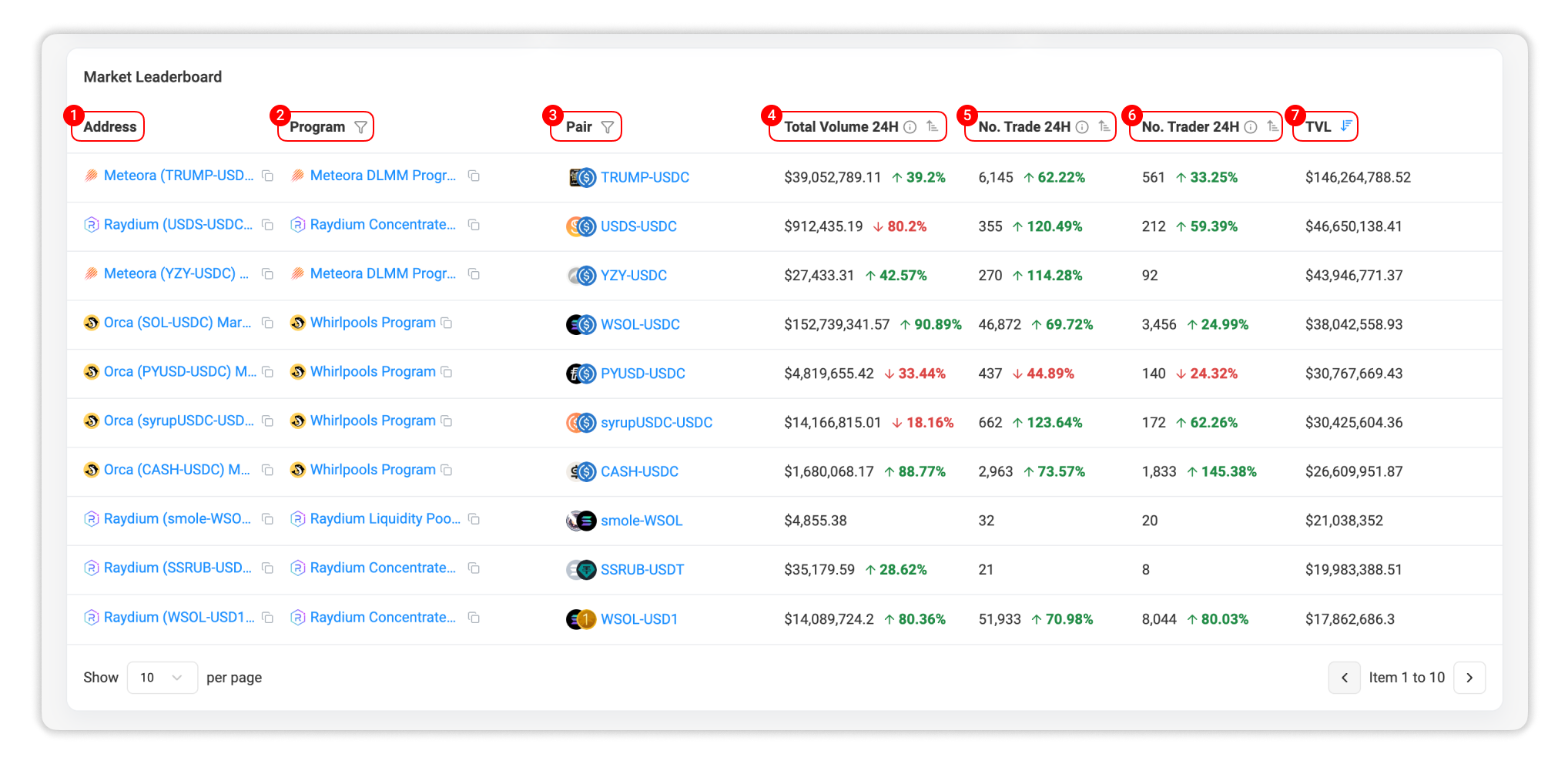

Section D: Market Leaderboard

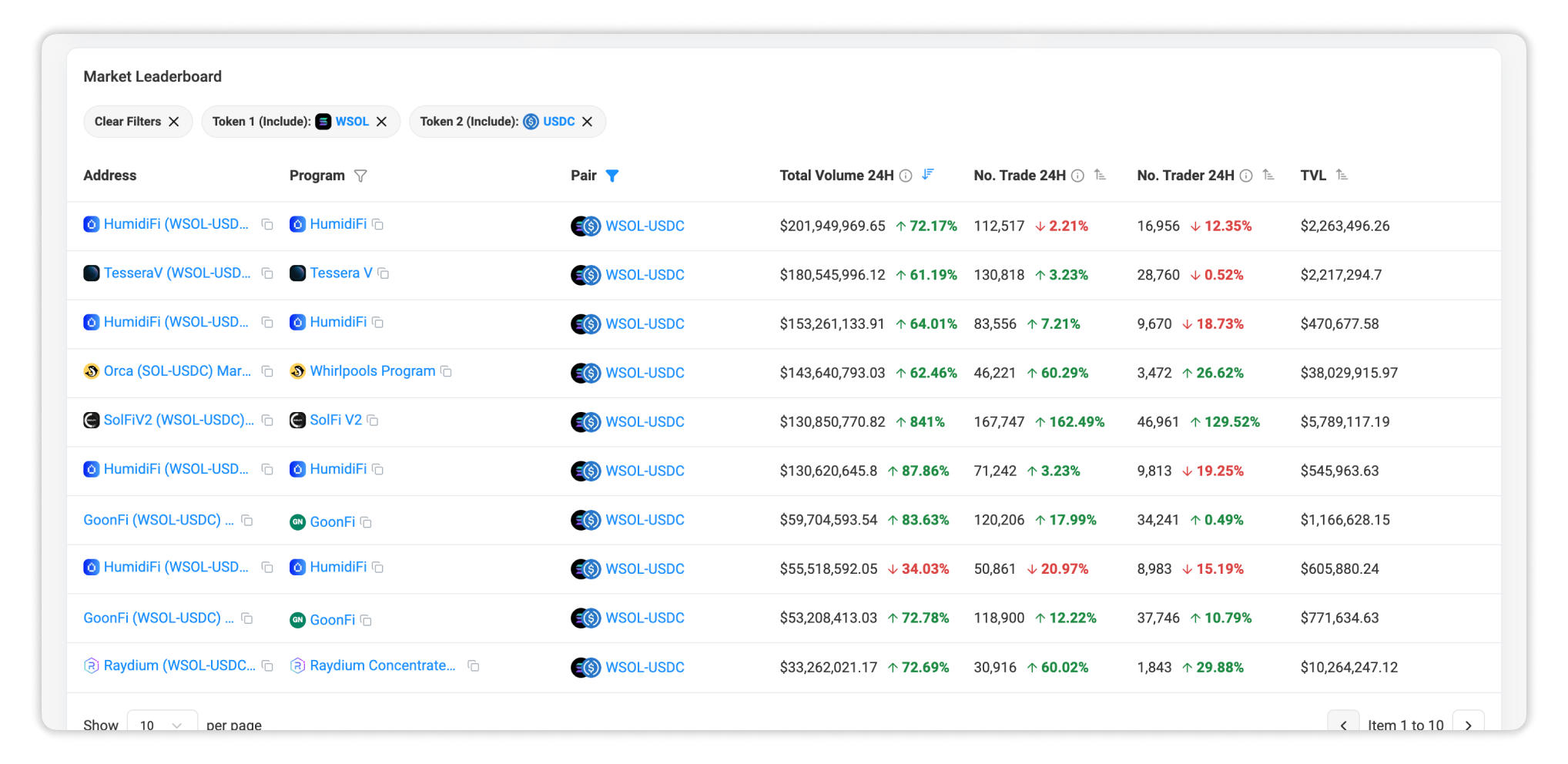

The Market Leaderboard provides a ranked list of markets with per-market statistics. Each row represents a market and its on-chain activity metrics.

- Address: The on-chain market or pool address.

- Program: The program associated with the market (for example, an AMM or DEX protocol). This helps attribute liquidity and volume to specific DeFi systems.

- Pair: The trading pair or pool composition (for example, SOL/USDC). This indicates which assets are being traded in the market.

- Total Volume (24H): The total volume traded through the market in the last 24 hours.

- No. of Trades (24H): The number of executed trades in the last 24 hours. Higher trade count typically indicates stronger activity or higher usage frequency.

- No. of Traders (24H): The number of unique traders who interacted with the market over the last 24 hours, reflecting market participation breadth.

- TVL: The total value locked in the market, representing liquidity depth available for trading.

The table supports sorting, allowing users to rank markets by TVL, volume, trade count, or trader count depending on their analysis objective.

In addition, users can filter by program address or market address using the column filters. This makes it easy to isolate activity for a specific protocol or inspect a known market directly.

Example Use Case

Suppose a user wants to evaluate which markets offer the largest liquidity for the SOL/USDC pair. On Solscan Market Leaderboard, they can:

- Filter the leaderboard using the Pair column to pick out only SOL/USDC markets.

- Sort by Total Volume 24H in descending order to compare markets, or use other metrics such as TVL, or number of trades/traders.

- Filter by Program to focus on a specific trading platform they prefer or are familiar with.

Conclusion

The Solscan Market Leaderboard provides a consolidated view of Solana DeFi market health and liquidity distribution. By combining ecosystem-wide overview metrics with a detailed market table, it enables users to track activity trends, identify high-liquidity markets, and compare market performance using transparent on-chain data.